“How’s the market?” is the question we are always asked. Regardless if it’s with family and friends, or at our open houses – people want to know. Being a transitory time in the market: now more than ever, the answer to this question is both crucial and detailed. Currently, our market is experiencing a shift – a slowing down (and in some areas a reversal) of price growth. Believe it or not, we see this as providing a number of great opportunities for both buyers and sellers.

First, let’s talk about what we mean by a “slowdown” in price appreciation. We mean that when we get to the end of the year and average out the last 12 months of median price and compare it to the previous 12 months of median price, we will still return a positive growth percentage on appreciation, but that percentage will be lower than calculations done earlier in the year. We had a very significant increase in prices in Q1 of 2022 that we see as likely to level off as 2022 progresses. It’s important to recall that the historical long-term housing price appreciation rate is much closer to a 3-6% annual average when analyzing and comparing the growth that we’ve experienced recently to the bigger picture.

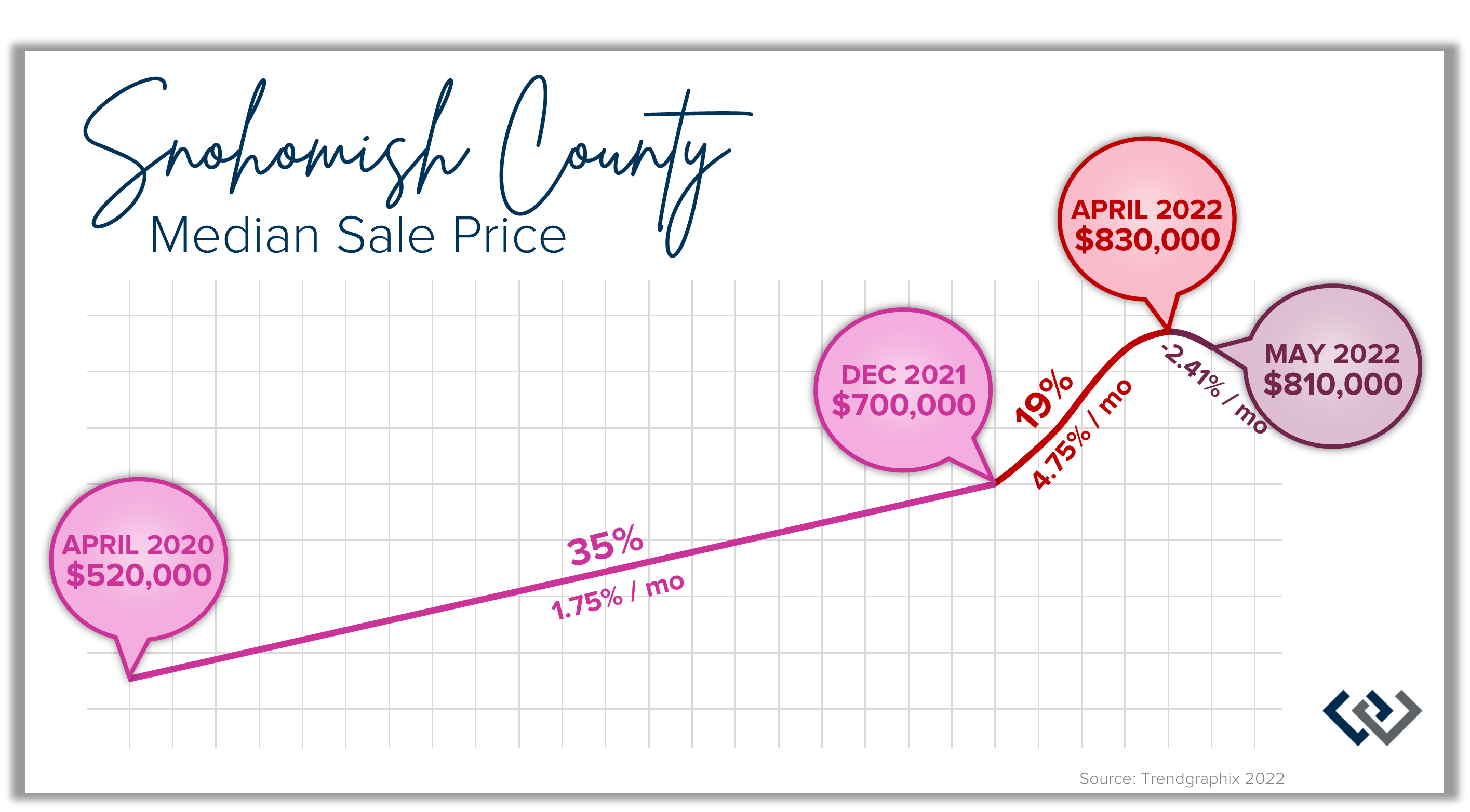

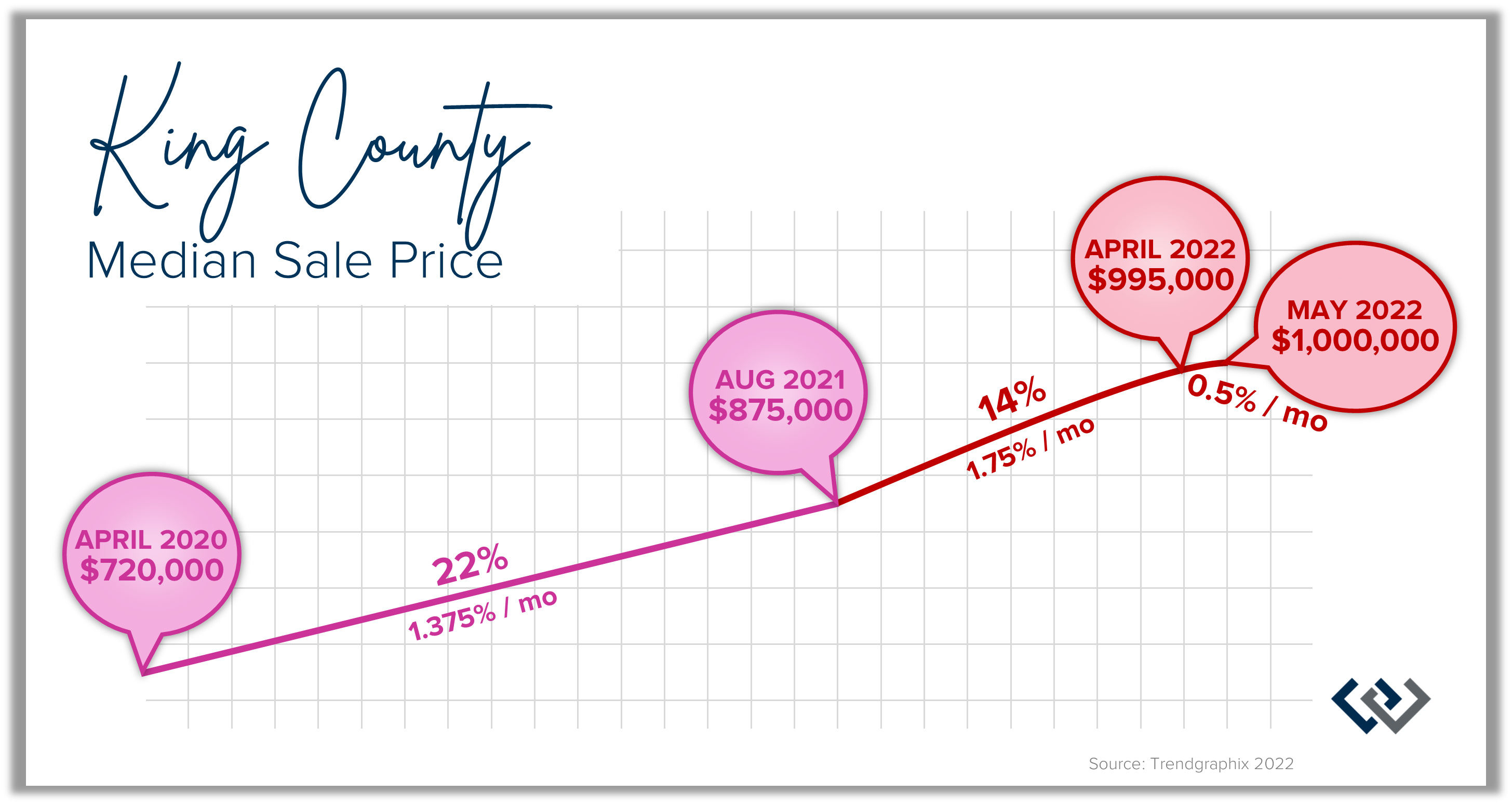

In Snohomish County, April 2020, the median home price was $520,000 and in April 2022 the median home price was $830,000 – that is a 60% increase in 2 years! In King County, April of 2020, the median home price was $720,000, and in April of 2022 that median price was $995,000 – this is a 38% increase in 2 years! That pace is unprecedented and, more importantly, unsustainable.

In Snohomish County, December 2021 (the end of last year) the median price was $700,000 which was an impressive 35% increase from April 2020 (20 months). But then Snohomish experienced a shocking 19% gain in the 4 months following that, from December 2021 to April 2022 (4 months: $700,000 to $830,000 = 19%). This 4-month stretch of price growth is the main root of the unsustainable growth and one that we will likely be leveling off during this adjustment. It is unlikely that we will depreciate to prices below the December 2021 level, despite that period already being at a well-above-average growth rate of 21% YoY from April 2020. The median price in May sits around $810,000 indicating the shift will likely settle somewhere between the April peak and where we landed at the end of last year. Bear in mind that 35% growth in 20 months is still unprecedented growth!

In Snohomish County, December 2021 (the end of last year) the median price was $700,000 which was an impressive 35% increase from April 2020 (20 months). But then Snohomish experienced a shocking 19% gain in the 4 months following that, from December 2021 to April 2022 (4 months: $700,000 to $830,000 = 19%). This 4-month stretch of price growth is the main root of the unsustainable growth and one that we will likely be leveling off during this adjustment. It is unlikely that we will depreciate to prices below the December 2021 level, despite that period already being at a well-above-average growth rate of 21% YoY from April 2020. The median price in May sits around $810,000 indicating the shift will likely settle somewhere between the April peak and where we landed at the end of last year. Bear in mind that 35% growth in 20 months is still unprecedented growth!

In King County, the percentages are not as extreme but still fell well-above average for home appreciation, especially when considering the higher starting nominal value. In August 2021, the median price was $875,000 which was already a 22% increase from April 2020 (15 months). But then King County saw a 14% gain over the next 9 months, from August 2021 to April 2022 (9 months: $875,000 to $995,000 = 14%). This 9-month stretch of price growth, though not as extreme as Snohomish County’s, is still one that will likely be leveling off during this shift. It is unlikely we will return to prices in King County below the August 2021 level, which was still an impressive growth rate of 22% from April 2020.

In King County, the percentages are not as extreme but still fell well-above average for home appreciation, especially when considering the higher starting nominal value. In August 2021, the median price was $875,000 which was already a 22% increase from April 2020 (15 months). But then King County saw a 14% gain over the next 9 months, from August 2021 to April 2022 (9 months: $875,000 to $995,000 = 14%). This 9-month stretch of price growth, though not as extreme as Snohomish County’s, is still one that will likely be leveling off during this shift. It is unlikely we will return to prices in King County below the August 2021 level, which was still an impressive growth rate of 22% from April 2020.

This is where perspective becomes critical and pricing gets a little tricky. Coaching soon-to-be sellers as to why it would be unrealistic, and potentially self-harming, to expect the peak pricing and competition of Q1 2022 requires explaining the market factors that have played into the current shift. The combination of the lowest inventory levels and lowest interest rates in American history that took place in Q1 2022 was the perfect storm that created intense price growth over a short period of time. Three main factors have led to this much-needed tempering in price growth: inventory, interest rates/inflation, and affordability.

Inventory

Although it is still a seller’s market, inventory has finally started to grow. In Snohomish County, 2021 was a white-hot seller’s market that never rose above 0.6 months of inventory; that’s barely over two weeks! For perspective, a seller’s market is traditionally defined as 0-3 months of inventory, a balanced market as 3-6 months, and a buyer’s market as 6 months and over. In May 2022, we sit at approximately 0.9 months of inventory (unofficially). Now we are starting to see more homes come to market, providing buyers with more selection. To illustrate, in April 2020 there were 996 new listings; in December 2021 there were 525 new listings; in April 2022 there were 1,503 new listings (almost triple as many as December), and (unofficially) in May there were 1,654 new listings. This additional selection is providing a shrinking pool of buyers the long-awaited option to find housing and has started to reduce the number of multiple offers – putting downward pressure on prices. When there is more supply, prices do not escalate as quickly.

For May 2022, we sit at 0.9 months of inventory (unofficially) in King County. In April 2020 there were 2,138 new listings; in December 2021 there were 1,103 new listings; in April 2022 there were 3,353 new listings (triple as many as in December), and (unofficially) in May 2022 there were 3,698 new listings.

Interest Rates

Interest rates have been steadily rising over the last two years and even more aggressively since the first of the year – specifically March. We are currently hovering around 6%, and at the start of 2022, we were hovering around 3%. With rising economic uncertainty, The Fed finally began announcing that they would begin raising rates and letting their MBSs expire in a process called Quantitative Tightening (QT), these are necessary tools to combat inflation. While 3%-4% rates were a dream, they were not a long-term reality; the 30-year average for interest rates is 7%, which highlights that 5-6% is still a great rate!

It is understandable that 5-6% pales in comparison to the historic lows we had and that buyers are upset, but it is unlikely we will see rates that low again or, at least, for a long time. Rates being as low as 2-3% in Q1 2022 played into the rapid acceleration in price because it made the buyer audience larger when we had the least amount of inventory available. The good news is that while they had a quick 2-point increase from March 2022 to May 2022 and a brief spike in June, they have seemed to stabilize. They have even come down a bit in the last week, making this our new normal for now, as future increases into 2023 are predicted. The good news for owners who secured a home in Q1 is they also secured the lowest debt service in history, so they should be very happy.

Affordability

Affordability has been a challenge for many, especially first-time home buyers. Affordability challenges with December 2021 prices were real, but the rise to April 2022 levels just served to remove buyers from the market. As price appreciation slows down and prices level off due to this shift in market conditions, some buyers will be able to reenter the market and start to secure their wealth-building asset that also complements their lifestyle.

Ultimately, it’s all about perspective. We have just made it through one of the most extreme seller’s markets of our time, which resulted in rapid price growth for owners and sellers with limited available options for buyers. That disparity is starting to ease up as we are heading back towards historical trendlines and, while that is happening, we will need to mentally keep the crazy 2022 Q1 price growth in a box alongside leprechauns and unicorns for the lucky sellers that received their pot of gold and buyers who secured the lowest rates ever. Good for them, but still good for anyone who has owned their home for longer than two years, as equity is now abundant.

Real estate has always been a long-hold slow-growing investment, but we have lost sight of that with the abnormality of the last two years. The most important thing we have lost sight of is that real estate (and specifically your primary residence) is a life decision. Our homes provide us with shelter, security, community, features, and benefits. In them, we can make memories, find comfort, and if we are fortunate, we are able to match our home to our lifestyle needs while building wealth at the same time.

With more selection, normal interest rates, and coming off the crazier prices of Q1, more buyers will be able to make these life pivots more comfortably while sellers will still make phenomenal returns. Perspective is key to helping separate the forest from the trees and, if not taken into account, could hinder us from reaching our eventual goals.

If you are curious about the value of your home in today’s market or are considering a purchase, please reach out. Even if you just want to talk these changes through and understand how they might affect your long-term goals. It is always our goal to help keep our clients and friends well informed and empower their strong decisions.

Brenden Covington

Trusted Real Estate Advisor

Windermere Real Estate/HLC

13901 NE 175th St, Suite 100 | Woodinville, WA 98072

Cell 206.617.4879 | Email bcovington@windermere.com